Is Pet Insurance Worth It? A Modern Pet Parent's Look at Whether or Not It's Worth It.

So, without further ado: It's not a pet, it's a family. And like any family member, they matter. But when a visit to the vet costs as much as a weekend away, and emergency surgery comes to more than buying a car, then pet insurance becomes relevant for everyone. It's not just a question of “Should I get it?” but “How can I not afford to?”

The Growth of Pet Insurance: The Numbers Are Cracking.

It didn's help the pet budget in the first quarter of 2025. Pet insurance sales in the United States increased 15%, the highest growth rate ever recorded, according to the Pet Health Insurance Association of America (PHIAA). This is in sharp contrast to Europe where more than 20 percent of pets are covered, 5 percent are nationally.

What is causing this increase? Let's dissect it:

The American Veterinary Medical Association (AVMA) reports that since 2024 pet care has increased 12% per year and ACL repairs are now $3,500 to $5,000. Technological Convenience: More than 40 per cent of insurers have integrated AI to reduce time loss in claims and current processing times are reduced by 60%. Before your guilt is removed, imagine filing a claim through an app and getting paid. Social Media Pressure: The use of Facebook and Reddit pet communities for insurance disputes increased by 37% in the past year. From ’Why am I paying $50 a month for nothing?’ to ‘This policy saved my dog's life!’ are examples of posts.

The pros and cons of the argument: Peace of Mind vs. Empty Pockets.

Pro-Insurance Camp

A Jake from Brooklyn. He said his 4-year-old Golden Retriever, Luna, had bloat (gastric torsion) last December – it's a &6,000; emergency surgery. Thanks to his * * HealthyPaws * * plan (90/50/month), he paid *$600* out of pocket. He posted on Reddit, “I’d be eating ramen for a year without insurance.”

Skeptics Speak Up

Then there is Sarah from Austin, who has spent $2,800 in five years for her healthy Beagle's insurance. ‘I’ve never claimed it. I feel like I’m burning money,’ she said frustrated in a Facebook group. People pick on loopholes: ‘My policy didn's cover my Lab's hip dysplasia because it's ‘genetic,” a user on X said.

Decoding Policies: What's Really Covered?

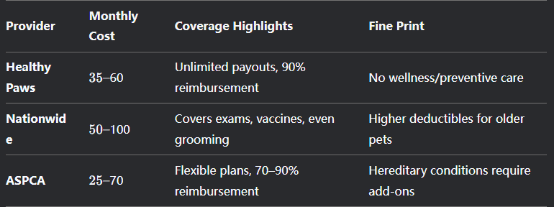

Not all plans are the same. Here's the lowdown on top U.S. providers:

The average monthly premium rose to $47 in 2024, up 8% from 2023. However, 60% of owners now choose 80% or higher reimbursement plans, focusing more on financial safety nets than on pinching pennies.

Real Stories, Real Stakes

The Save

When Denver resident Mia's French Bulldog, Gizmo, ingested a squeaky toy and required emergency surgery at $8,200. Her Nationwide plan covered $8,200. She had $1,200 left after her Nationwide plan covered $7,000. “I cried when the claim went through. That policy gave me my dog back,” she shared on Instagram.

The Regret

San Diego cat owner Ryan didn't get insurance. When his Maine Coon, Loki, needed a $4,500 urinary blockage surgery, he drained his savings and started a GoFundMe. ‘I didn't think it would happen to us,” he wrote. Now I’m Panicking.”

Future of Pet Insurance: What's Coming Next?

Hyper Personalized Plans: New age companies like Policy Advisor uses AI to recommend policies to pets based on their breed, age, and health conditions. Block-chain Transparency: A 2024 newcomer, PetSure uses block-chain for claims, a feature that allows owners to see every step of the process in real time — no more ‘Where's my reimbursement?’ emails. Wellness Bundles: More plans are expected to offer insurance together with additional benefits like telehealth vet visits or discounted pet tech (a GPS tracker or smart feeder, for example).

But challenges loom:

Affordability Gap: Premiums are still an issue for low income pet owners. Trust Issues: There is much work to be done in the insurer to exclude complex policy language and gaps in coverage.

So Is It Worth It?

Now let's get real: If your pet is a healthy young mutt and you have $5k+ in emergency savings, you might not need it. But for purebreds that tend to develop problems (you know who Bulldogs and Persians are) or budget conscious owners, insurance can be a godsend.

As vet costs continue to rise (they are expected to increase by 7% annually up to 2030), the numbers suggest ‘it's better to be safe than sorry.’ Just ask Jake: ”Luna's my kid. I would skip health insurance for my human child? No way.”

Response:

Is Pet Insurance Worth It? Everything you should know as a modern pet parent before investing in pet insurance.

So let's just do this: That wag or purr is not just a pet, it is family. And like any family member, they count. But when a visit to the vet costs as much as a weekend away, and emergency surgery comes to more than buying a car, then pet insurance becomes relevant for everyone. It isn't just a question of “Should I get it?” but “How can I not afford to?”

The Growth of Pet Insurance: A Look at the Data.

The first quarter of 2025 wasn't good for pet budgets. Sales of pet insurance in the United States increased 15%, the highest growth rate ever recorded, the Pet Health Insurance Association of America (PHIAA) reported. This is in sharp contrast to Europe where more than 20 percent of pets are covered, only 5 percent are nationally.

What is causing this increase? Let's dissect it:

The American Veterinary Medical Association (AVMA) reports that since 2024, the cost of pet care has increased by 12% year, with treatments such as ACL repairs now costing an average of $3,500 to $5,000. Technological Convenience: More than 40 per cent of insurers have integrated AI to reduce time loss in claims and current processing times are reduced by 60%. Before your guilt is removed, imagine filing a claim through an app and getting paid. Social Media Pressure: The use of Facebook and Reddit pet communities for insurance disputes increased by 37% in the past year. From ’Why am I paying $50 a month for nothing?’ to ‘This policy saved my dog's life!’ are examples of posts.

The Great Debate: Peace of Mind vs. Empty Pockets.

Pro-Insurance Camp

A Jake from Brooklyn. He said his 4-year-old Golden Retriever, Luna, had bloat (gastric torsion) last December – it's a $6,000 emergencysurgery. Thanks to his HealthyPaws plan (906,000 emergency surgery. Thankstohis HealthyPaws plan(9050/month), he paid only $600 out of pocket. “Without insurance, I’d be eating ramen for a year,” he posted on Reddit.

Skeptics Speak Up

Then there's Sarah from Austin, who's paid $2,800 over five years for her healthy Beagle. “I’ve never filed a claim. It feels like lighting money on fire,” she vented in a Facebook group. People pick on loopholes: “My policy didn't cover my Lab's hip dyspepsia because it's ‘genetic,” a user on X said.

Decoding Policies: What's Actually Covered?

Not all plans are created equal. Here's the lowdown on top U.S. providers:

The average monthly premium hit $47 in 2024—up 8% from 2023. But here's the kicker: 60% of owners now opt for 80%+ reimbursement plans, prioritizing financial safety nets over penny-pinching.

Real Stories, Real Stakes

The Save

When Denver resident Mia's French Bulldog, Gizmo, swallowed a squeaky toy whole, emergency surgery cost $8,200. Her Nationwide plancovered 8,200. Her Nationwide plancovered $7,000, leaving her with a manageable $1,200 bill. “I cried when the claim went through. That policy gave me my dog back,” she shared on Instagram.

The Regret

In contrast, San Diego cat owner Ryan opted out of insurance. When his Maine Coon, Loki, needed a $4,500 urinary blockage surgery, he drained his savings and started a GoFundMe. “I never thought it’d happen to us,” he wrote. “Now I’m scrambling.”

The Future of Pet Insurance: Trends to Watch

Hyper-Personalized Plans: Startups like Policy Advisor use AI to match pets with tailored policies based on breed, age, and health history. Block-chain Transparency: A 2024 newcomer, PetSure, uses block-chain for claims, letting owners track every step in real time—no more “Where's my reimbursement?” emails. Wellness Bundles: Expect more plans bundling insurance with perks like telehealth vet calls or discounted pet tech (think GPS trackers or smart feeders).

But challenges loom:

Affordability Gap: Low-income pet owners still struggle with premiums. Trust Issues: Insurers must simplify policy jargon and close coverage loopholes.

So Is It Worth It?

Let's get real: If your pet is a healthy young mutt and you’ve got $5k+ in emergency savings, you might skip it. For purebreds prone to issues (looking at you, Bulldogs and Persians) or budget-conscious owners, insurance can be a lifeline.

As vet costs keep climbing (projected 7% annual increases through 2030), the math tilts toward “better safe than sorry.” Just ask Jake: “Luna's my kid. Would I skip health insurance for my human child? No way.”