In today's rapidly evolving financial landscape, the world of cryptocurrency has experienced an astonishing growth trajectory, transforming from a relatively niche market into a formidable force in global finance. Digital assets, such as Bitcoin and Ethereum, have captured the imagination of investors around the world, presenting exciting opportunities while also bringing with them a complex web of challenges and risks. This comprehensive guide delves deep into the essential aspects of digital asset investment, providing valuable insights into market dynamics, investment strategies, regulatory considerations, and real-world success stories.

1. What is Cryptocurrency?

Cryptocurrency is a revolutionary type of digital or virtual currency that employs cryptography to ensure security. This makes it nearly impossible to counterfeit or double-spend, providing a level of security that traditional currencies often lack. Unlike traditional currencies, which are controlled by central banks, cryptocurrencies are decentralized and built on blockchain technology. This distributed ledger is enforced by a network of computers, ensuring the integrity and transparency of transactions.

The most prominent cryptocurrencies include Bitcoin, which holds the distinction of being the first and largest by market capitalization. Bitcoin has paved the way for the cryptocurrency revolution, demonstrating the potential of a decentralized currency. Ethereum, on the other hand, is renowned for its smart contract functionality, enabling the creation and execution of self-executing contracts without the need for intermediaries. These digital assets have completely transformed our perception of money, transactions, and investments.

2. The Appeal of Digital Asset Investment

Digital assets have managed to attract the attention of investors from all corners of the globe due to their unique and compelling characteristics.

High Returns Potential: Early adopters and investors in Bitcoin and other cryptocurrencies have witnessed astronomical returns. For instance, Bitcoin's price skyrocketed from less than $1 in 2010 to over $60,000 in 2021. This meteoric rise has created a new class of billionaires and has demonstrated the potential for significant wealth creation.

Decentralization and Accessibility: Unlike traditional assets that are often controlled by banks or governments, cryptocurrencies operate without intermediaries. This offers accessibility to anyone with an internet connection, regardless of their location or financial status. It provides an opportunity for individuals who may be excluded from traditional financial systems to participate in the global economy.

Inflation Hedge: Cryptocurrencies like Bitcoin are frequently considered a hedge against inflation. Due to their limited supply, they are seen as a store of value that can protect wealth from the eroding effects of inflation on fiat currencies. As central banks around the world continue to print money, the appeal of a limited-supply asset like Bitcoin grows.

3. Key Strategies for Digital Asset Investment

Investing in digital assets can be highly lucrative, but it demands a well-thought-out and strategic approach. Here are some key strategies to consider:

A. HODLing (Buy and Hold Strategy): The term "HODL" originated from a misspelling of "hold" in a Bitcoin forum but has since evolved into a widely recognized investment strategy. HODLing involves purchasing cryptocurrencies and holding onto them for the long term, regardless of the market's volatility. This strategy is based on the belief that the value of digital assets will increase significantly over time. For example, an investor who bought Bitcoin in 2010 and held onto it through various market fluctuations could have seen their investment grow exponentially.

B. Dollar-Cost Averaging (DCA): DCA is a prudent strategy where investors buy a fixed dollar amount of an asset at regular intervals, regardless of its price. This approach helps reduce the impact of market volatility and mitigates the risks associated with making a large purchase at an unfavorable time. By spreading out investments over time, investors can take advantage of market fluctuations and potentially lower their average cost per unit.

C. Staking and Yield Farming: Staking involves holding cryptocurrency in a wallet to support the operations of a blockchain network. In return, investors receive staking rewards, often in the form of additional coins. Yield farming, which is popular in the decentralized finance (DeFi) space, allows investors to earn interest by providing liquidity to DeFi protocols. This can be a way to generate passive income from digital assets.

D. Diversification: Investing in a variety of digital assets instead of concentrating all funds in one cryptocurrency is a crucial risk management strategy. Diversification might include investing in different types of tokens, such as utility tokens that provide access to specific services, stablecoins that are pegged to a stable asset like the US dollar, and NFTs (non-fungible tokens) that represent unique digital assets. By spreading investments across different assets, investors can reduce the risk of a significant loss if one particular asset underperforms.

4. Risks of Investing in Cryptocurrencies

While digital assets offer the potential for high returns, they also come with substantial risks that investors must be aware of.

Market Volatility: Cryptocurrencies are notoriously volatile, with prices often experiencing wild swings in short periods. This can lead to substantial gains, but it also poses the risk of steep losses. For example, a cryptocurrency that experiences a rapid price increase one day could plummet the next, leaving investors with significant losses.

Regulatory Risks: Governments around the world are still grappling with how to regulate cryptocurrencies. Regulatory actions, such as bans or strict regulations, can have a significant impact on market prices and the ability to trade. Uncertainty surrounding regulation can create instability in the market and make it difficult for investors to predict the future of their investments.

Security Risks: Despite the security features of blockchain technology, cryptocurrencies are vulnerable to hacking, fraud, and phishing attacks. Investors must take precautions such as using hardware wallets, which offer offline security, and ensuring they use secure platforms to protect their assets. The loss of private keys or falling victim to a cyberattack can result in the loss of all digital assets.

5. Real-World Success Stories in Crypto Investment

Michael Saylor – Betting Big on Bitcoin: Michael Saylor, the CEO of MicroStrategy, made headlines by investing over $4 billion of the company's treasury into Bitcoin. Saylor's bold move was based on his belief that Bitcoin is a superior store of value compared to cash. Despite initial skepticism, his strategy paid off as Bitcoin's price surged, significantly increasing MicroStrategy's market capitalization. His actions have inspired other companies to consider adding Bitcoin to their balance sheets.

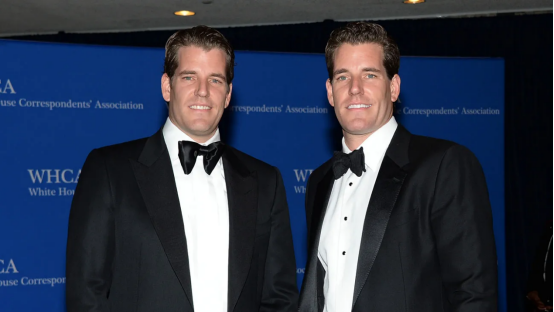

The Winklevoss Twins – Early Crypto Pioneers: Tyler and Cameron Winklevoss, known for their involvement with Facebook, were among the first Bitcoin billionaires. They founded Gemini, a cryptocurrency exchange that emphasizes security and regulatory compliance. The twins are vocal advocates of Bitcoin, viewing it as the digital equivalent of gold. Their early investment and entrepreneurial efforts have contributed to the growth and legitimacy of the cryptocurrency space.

Elon Musk – Crypto's Most Influential Figure: Elon Musk's involvement in the crypto world, particularly with Bitcoin and Dogecoin, has had a massive impact. Tesla's decision to purchase $1.5 billion in Bitcoin and accept it as a payment option marked a significant endorsement of digital currencies. Musk's tweets and public comments continue to influence market movements, highlighting the power of public figures in the crypto space. His actions have shown how a single individual can have a profound impact on the cryptocurrency market.

6. Regulatory Landscape and Legal Considerations

The regulatory landscape for cryptocurrencies varies significantly across the globe, creating a complex environment for investors.

United States: The Securities and Exchange Commission (SEC) classifies certain cryptocurrencies as securities, subjecting them to strict regulations. In recent years, the U.S. has focused on addressing crypto fraud, ensuring investor protection, and implementing anti-money laundering measures. The regulatory approach in the U.S. is evolving, and investors need to stay informed to comply with the law.

European Union: The EU is advancing its regulatory framework with the Markets in Crypto-Assets (MiCA) regulation. This aims to provide clarity and legal certainty for crypto assets and their service providers. The EU's efforts to regulate the crypto space reflect the growing importance of digital assets in the European financial ecosystem.

China: China has taken a strict stance on cryptocurrencies, banning all cryptocurrency transactions and mining. This is due to concerns over financial stability and energy consumption. The Chinese government's actions have had a significant impact on the global cryptocurrency market.

Investors should stay informed about regulatory changes in their jurisdictions and consider consulting a Financial Advisor to navigate the legal complexities of digital asset investments. Understanding the regulatory environment is crucial for making informed investment decisions and avoiding legal pitfalls.

7. Tools and Resources for Crypto Investors

Crypto Exchanges: Platforms like Coinbase, Binance, and Kraken allow users to buy, sell, and trade cryptocurrencies. When choosing an exchange, it's essential to consider factors such as security, fees, and the availability of assets. A secure exchange with a wide range of assets and reasonable fees can make a significant difference in an investor's experience.

Wallets: Digital wallets are essential for storing cryptocurrencies. Hardware wallets, such as Ledger and Trezor, offer offline security, protecting against cyberattacks. Software wallets like MetaMask provide easy access for trading and staking but may be more vulnerable to online threats. Choosing the right wallet depends on an investor's needs and risk tolerance.

Educational Resources: Platforms like Investopedia, CoinDesk, and CryptoCompare offer valuable information on market trends, investment strategies, and news updates. Staying informed about the cryptocurrency market is crucial for making intelligent investment decisions. These resources can help investors understand the complex world of digital assets and stay ahead of market developments.

8. Tax Implications of Crypto Investments

Cryptocurrencies are generally treated as property for tax purposes, meaning capital gains tax applies when you sell or trade digital assets. Keeping detailed records of your transactions is essential for accurately reporting your crypto gains and losses. Tax regulations can vary from one jurisdiction to another, so working with a tax professional who is knowledgeable about digital assets is advisable. Understanding your tax obligations can help you avoid penalties and ensure compliance with the law.

Personal Opinion: Navigating the Future of Digital Asset Investment

In my view, the rise of digital assets represents one of the most exciting shifts in the financial world. Cryptocurrencies are not just another investment vehicle; they symbolize a new era of decentralized finance, empowerment, and innovation. However, this market is not without its challenges. Success in crypto investing requires a solid understanding of the risks, a disciplined approach, and constant vigilance to regulatory developments.

The potential of digital assets extends beyond profits. They offer a chance to participate in a financial revolution that could redefine global finance. For those willing to educate themselves and take calculated risks, the world of digital assets offers unparalleled opportunities for growth and financial independence.