The Rise of ESG Investing

In recent years, Environmental, Social, and Governance (ESG) investing has emerged as a transformative force within the realm of modern finance. What was once considered a niche concept has now evolved into a central pillar that is reshaping the investment landscape. As concerns over climate change, social inequality, and corporate governance issues continue to grow, an increasing number of investors are actively seeking ways to align their financial goals with their deeply held personal values. ESG investing offers a unique and powerful opportunity to not only achieve competitive financial returns but also to make a tangible and positive impact on the world we live in. This article delves deep into the essentials of ESG investing, exploring its numerous benefits, diverse strategies, inspiring success stories, and examining why this approach is truly redefining the future of finance.

Understanding ESG Investing

ESG investing involves a comprehensive evaluation of companies based on a combination of their environmental, social, and governance practices, in addition to the traditional financial metrics. The overarching goal is to identify businesses that not only demonstrate sound financial health but also act as responsible stewards of society and the environment.

Environmental (E): This crucial component assesses how a company manages its environmental responsibilities. It takes into account various factors such as carbon emissions, water usage, waste management, and the company's efforts to combat climate change. Companies that are leaders in this category often make significant investments in renewable energy sources, sustainable resource management strategies, and pollution control measures. For example, a company that installs solar panels on its facilities to reduce its reliance on fossil fuels or one that implements water recycling systems to minimize its water consumption is demonstrating a strong environmental commitment.

Social (S): The social aspect of ESG focuses on how companies interact with and treat their employees, customers, and the communities in which they operate. Key factors in this area include labor rights, diversity and inclusion initiatives, community engagement efforts, and customer satisfaction levels. Companies that score highly in social criteria typically prioritize ethical supply chains, ensure workplace safety, and promote equitable treatment for all. For instance, a company that offers fair wages and benefits to its employees, actively supports local community projects, and has a diverse leadership team is likely to be seen as socially responsible.

Governance (G): Governance refers to a company's internal control systems, leadership structure, shareholder rights, and transparency. Strong governance practices are essential to ensure that companies operate in an ethical manner, mitigate the risk of corruption, and are accountable to their shareholders. This includes having clear policies on executive compensation, board independence, and shareholder voting rights. A company with robust governance is more likely to make sound decisions that benefit all stakeholders in the long run.

The Surge in ESG Investing

The meteoric rise of ESG investing can be attributed to a growing awareness of the pressing global challenges we face today, such as climate change, inequality, and corporate scandals. Investors ranging from individual retail investors to large institutional players are recognizing that businesses with robust ESG practices often exhibit greater resilience, lower risk, and enhanced long-term profitability. According to a report by the Global Sustainable Investment Alliance, ESG assets are projected to reach an astonishing figure of over $50 trillion by 2025, clearly highlighting the rapid shift toward responsible investing. This trend is not only driven by ethical considerations but also by the realization that sustainable businesses are better positioned to thrive in an evolving economic landscape.

Benefits of ESG Investing

Risk Mitigation and Long-Term Stability: Companies with strong ESG practices are better equipped to handle a wide range of challenges, including regulatory changes, environmental disasters, and social controversies. By prioritizing ESG factors, investors can effectively avoid companies with high reputational and operational risks. This leads to more stable and secure investments, as companies that are committed to sustainability and ethical behavior are less likely to face major disruptions or scandals. For instance, a company that has implemented sustainable sourcing practices is less likely to be affected by supply chain disruptions caused by environmental disasters or social unrest.

Competitive Returns: Contrary to the common misconception that ESG investing necessarily compromises returns, numerous studies have consistently shown that companies that excel in ESG criteria often outperform their peers. A study by Morgan Stanley found that sustainable funds not only delivered returns similar to traditional funds but also provided lower downside risk, particularly during market downturns. This indicates that ESG investing can be a smart financial strategy that does not sacrifice profitability. For example, a company that invests in energy-efficient technologies may see cost savings over time, which can translate into higher earnings and stronger stock performance.

Positive Societal Impact: ESG investing allows investors to actively contribute to societal and environmental improvements. By supporting companies that prioritize sustainability and ethical practices, investors can play a significant role in driving the global shift toward a greener and more equitable economy. This can have a ripple effect, inspiring other companies to follow suit and creating a positive cycle of change. For instance, investing in a company that develops affordable clean energy solutions can help reduce carbon emissions and improve access to energy for underserved communities.

Key ESG Investment Strategies

Exclusionary Screening: This strategy involves deliberately excluding companies that engage in activities considered harmful or unethical. For example, investors may choose to avoid companies involved in tobacco production, fossil fuel extraction, or weapons manufacturing. By doing so, they can ensure that their investments do not support industries that conflict with their ethical values. This approach allows investors to have a more targeted and values-driven investment portfolio.

Thematic Investing: Thematic investing focuses on specific ESG themes that are of particular interest to investors. These themes can include renewable energy, clean technology, gender diversity, or any other area that aligns with an investor's values and goals. By concentrating on specific themes, investors can target sectors that have high growth potential and a significant positive impact. For instance, an investor passionate about gender equality might choose to invest in companies that have strong policies on promoting women in leadership positions.

Impact Investing: Impact investing goes a step further by seeking to generate measurable positive impact alongside financial returns. This approach often involves investing in companies or projects that are directly addressing social and environmental issues. Examples include affordable housing initiatives, sustainable agriculture programs, or educational projects. Impact investing allows investors to have a direct and tangible impact on the issues they care about while still achieving financial gains.

ESG Integration: ESG integration involves incorporating ESG factors into traditional financial analysis. This holistic approach evaluates how a company's ESG performance can affect its long-term financial health and viability. By considering ESG factors alongside financial metrics, investors can make more informed decisions and identify companies that are truly sustainable and resilient. For example, an investor might analyze a company's carbon emissions reduction targets and how they could impact the company's future profitability.

Notable ESG Investors and Success Stories

Larry Fink – The BlackRock Approach: Larry Fink, the CEO of BlackRock, the world's largest asset manager, has been a vocal and influential advocate for ESG investing. Fink has emphasized that climate risk is investment risk and has committed BlackRock to integrating ESG criteria across its extensive portfolios. By urging companies to adopt sustainable practices, Fink has positioned BlackRock as a leader in responsible investing. This has not only had a significant impact on the companies in BlackRock's portfolios but has also set an example for the entire investment industry.

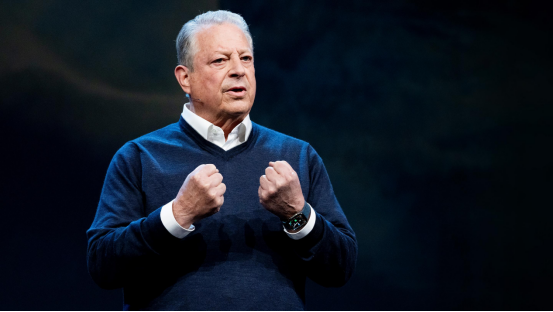

Al Gore – A Visionary in Sustainable Investing: Former U.S. Vice President Al Gore co-founded Generation Investment Management to promote sustainable investing. The firm focuses on long-term investments with a strong emphasis on ESG factors. Gore's approach has demonstrated that sustainability can indeed drive strong financial performance. His efforts have set a precedent for integrating ethical considerations into mainstream investment strategies and have inspired many other investors to follow suit.

Catherine Wood – Innovating with ESG at ARK Invest: Catherine Wood, the CEO of ARK Invest, integrates ESG criteria into her innovation-focused investment strategies. Particularly in disruptive sectors such as electric vehicles and genomics, Wood's commitment to sustainable innovation underscores the potential for ESG-focused investments to drive both financial returns and societal impact. By identifying companies that are at the forefront of sustainable innovation, Wood is helping to shape the future of investing.

ESG Ratings and the Role of Data Providers

ESG ratings provided by organizations like MSCI, Sustainalytics, and Bloomberg are essential tools for investors seeking to assess companies' ESG performance. These ratings evaluate companies based on detailed criteria and offer valuable insights into their sustainability, ethical standards, and governance practices. However, it's important to note that ESG ratings can vary significantly from one provider to another. Therefore, investors should critically assess these scores and consider multiple sources to ensure they align with their specific investment goals. By doing so, investors can make more informed decisions and avoid relying solely on a single rating.

Legal and Regulatory Trends in ESG Investing

The regulatory landscape surrounding ESG investing is in a state of rapid evolution. Governments and regulatory bodies around the world are implementing guidelines and regulations to enhance transparency, accountability, and sustainability in the financial sector. For example, the European Union's Sustainable Finance Disclosure Regulation (SFDR) and the U.S. Securities and Exchange Commission's (SEC) focus on climate-related disclosures are driving companies to improve their ESG reporting and practices. Investors need to stay informed about these developments to leverage the opportunities presented by ESG investing and comply with emerging standards. Engaging with a Financial Advisor can be extremely helpful in navigating the complexities of ESG regulations and aligning investment strategies with legal requirements.

How to Start ESG Investing

Define Your ESG Goals: The first step in ESG investing is to clearly identify which ESG factors are most important to you. Whether it's environmental sustainability, social equity, or corporate accountability, aligning your investments with your values is crucial. Take the time to reflect on your personal beliefs and priorities to determine what kind of impact you want to make through your investments.

Research and Choose Your Investments: Utilize ESG ratings, company sustainability reports, and tools like Online Banking platforms to evaluate potential investments. Look for funds and companies that demonstrate strong ESG performance and match your specific criteria. For example, you might research companies that have a track record of reducing carbon emissions, promoting diversity and inclusion, or having strong corporate governance practices.

Build a Diversified ESG Portfolio: Diversification is key to managing risk in any investment portfolio. Construct a balanced portfolio that includes a mix of stocks, bonds, and funds with a focus on high ESG standards. By spreading your investments across different asset classes and sectors, you can reduce the impact of any single investment on your overall portfolio.

Monitor and Adjust Your Strategy: ESG investing is a dynamic field, and it's important to stay updated on ESG trends, regulatory changes, and company performance. Continuously monitor your investments and be prepared to adjust your strategy as needed to ensure that your investments remain aligned with your financial and ethical goals. For example, if a company you've invested in experiences a significant change in its ESG performance, you may need to reevaluate your position.

Personal Opinion: Why ESG Investing Matters More Than Ever

In my view, ESG investing is truly reshaping the financial landscape by highlighting the importance of sustainability, ethics, and accountability. As the global challenges of climate change and social inequality become increasingly urgent, investors have the unique power to drive meaningful change through their financial choices. ESG investing represents a critical shift toward a future where profit and purpose go hand in hand.

The rise of ESG investing is not just about financial returns; it's about building a better world. By integrating ESG factors into investment decisions, we can support companies that are making a positive impact and set a new standard for responsible business practices. For investors looking to align their financial goals with their values, ESG investing offers an opportunity to make a difference—one investment at a time.